The 4-Minute Rule for Estate Planning Attorney

The 4-Minute Rule for Estate Planning Attorney

Blog Article

The Best Strategy To Use For Estate Planning Attorney

Table of ContentsGetting The Estate Planning Attorney To WorkThe Basic Principles Of Estate Planning Attorney The Only Guide to Estate Planning AttorneySome Ideas on Estate Planning Attorney You Need To KnowSee This Report on Estate Planning Attorney

The age of majority in a provided state is established by state regulations; generally, the age is 18 or 21. Some assets can be distributed by the establishment, such as a financial institution or brokerage firm, that holds them, so long as the owner has offered the appropriate instructions to the banks and has called the beneficiaries who will certainly receive those assets.For instance, if a recipient is called in a transfer on fatality (TOD) account at a brokerage firm, or payable on fatality (POD) account at a bank or cooperative credit union, the account can usually pass straight to the beneficiary without experiencing probate, and thus bypass a will. In some states, a comparable beneficiary designation can be contributed to property, enabling that asset to likewise bypass the probate process

When it comes to estate preparation, a seasoned estate attorney can be a very useful possession. Collaborating with an estate preparation attorney can give many advantages that are not readily available when attempting to finish the procedure alone. From providing experience in lawful issues to helping produce a thorough prepare for your family's future, there are several advantages of dealing with an estate planning lawyer.

Estate attorneys have extensive experience in recognizing the subtleties of various legal papers such as wills, trusts, and tax obligation legislations which allow them to provide sound advice on just how best to safeguard your assets and ensure they are given according to your wishes. An estate attorney will certainly additionally be able to supply suggestions on how finest to browse intricate estate laws in order to guarantee that your desires are recognized and your estate is taken care of properly.

3 Simple Techniques For Estate Planning Attorney

They can commonly supply recommendations on exactly how finest to update or develop brand-new papers when needed. This may include suggesting changes in order to make the most of brand-new tax obligation benefits, or simply guaranteeing that all relevant documents mirror the most current recipients. These lawyers can likewise provide recurring updates connected to the administration of counts on and various other estate-related issues.

The goal is constantly to guarantee that all documents stays lawfully accurate and reflects your present dreams precisely. A major benefit of dealing with an estate planning lawyer is the invaluable guidance they offer when it concerns preventing probate. Probate is the legal procedure throughout which a court figures out the credibility of a departed individual's will and manages the distribution of their properties based on the terms of that will.

An experienced estate attorney can help to make certain that all necessary papers are in location which any kind of properties are properly distributed according to the regards to a will, avoiding probate entirely. Ultimately, collaborating with an experienced estate preparation attorney is just one of the most effective methods to ensure your long for your family members's future are accomplished accordingly.

Estate Planning Attorney - Truths

Such trust funds normally consist of arrangements which shield advantages obtained with government programs while enabling trustees to keep limited control over how properties are handled in order to maximize benefits for those entailed. Estate attorneys recognize just how these depends on job and can provide vital help setting them up effectively and guaranteeing that they continue to be legitimately compliant over time.

An estate planning lawyer can assist a moms and dad include arrangements in their will certainly for the care and management of their minor children's assets. Lauren Dowley is a knowledgeable estate preparation attorney that can assist you develop a plan that fulfills your certain demands. She will deal with you to comprehend your assets and just how you desire them to be dispersed.

Do not wait to start estate preparation! It's one of the most vital things you can do for on your own and your enjoyed ones.

Get This Report about Estate Planning Attorney

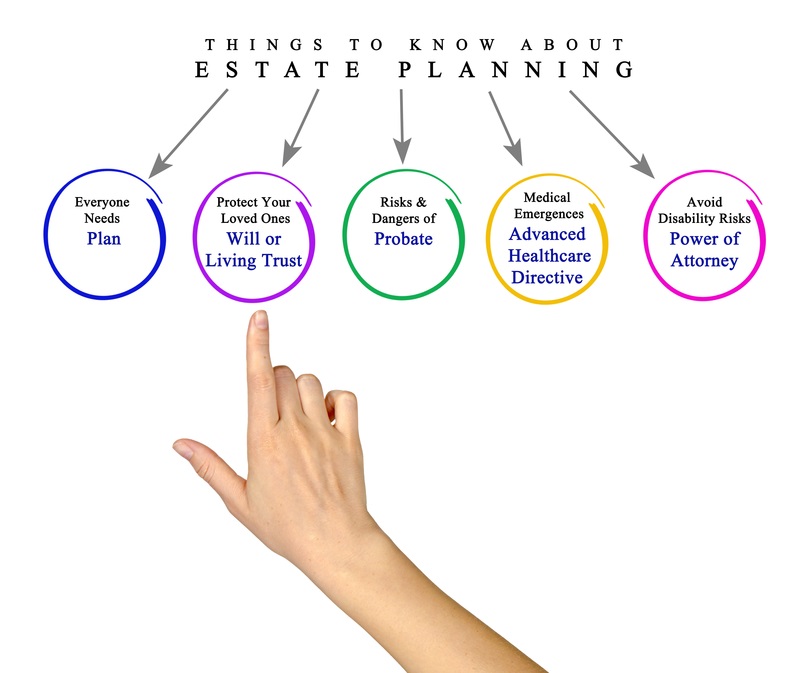

Producing or updating existing estate preparation documents, including wills, trust funds, healthcare directives, powers of attorney, and related tools, is one of one of the most important things you can do to guarantee your wishes will certainly be honored when you pass away, or if you become unable to handle your events. In today's digital age, there is no lack of diy options for estate preparation.

Doing so can result in your estate you could check here plan not doing what you desire it to do. Wills, depends on, and other estate intending records need to not be something you prepare as soon as and never take another look at.

Probate and depend on regulations are state-specific, and they do transform from time-to-time. Dealing with a lawyer can provide you assurance understanding that your strategy fits within the specifications of state law. Among the greatest risks of taking a do-it-yourself technique to estate planning is the danger that your documents will not really page achieve your goals.

If you don't comprehend or misunderstand what an on the internet kind company is asking, you will certainly have squandered cash on records that will not help your wanted result. Maybe even worse, the majority of mistakes in estate planning papers aren't learnt until after a person passes away. At that factor, it's far too late to make adjustments.

All about Estate Planning Attorney

Report this page